In a previous article, I was explaining the importance of using a Line of Credit (LoC) for bootstrapping a startup under a "lean" approach. Well, I have to say that after more than a year, I have applied Profit First (PF) successfully with an LoC by setting it up as "overdraft protection" on the Operations Account. I love the way these both combine and the flexibility this mix brings into my business banking.

The use of overdraft protection, together with the PF system brings many benefits for business owners (especially new entrepreneurs):

Develop Your Debt Management "Muscle": Debt is part of all successful businesses in the world. You will learn more about it in the next section, but so far, this approach will help you develop the skills to do so.

Consolidate a Profit First approach: Profit First works excellent, but you need a real-life business mindset. Using the overdraft protection together with Profit First is an effective way of respecting asset allocation and staying aligned with the system's purpose.

Leverage your Business with less Risk: Getting a loan for building up a business is risky. On the other hand, an LoC is a more flexible approach, both for re-payment deadlines and interest payments.

But even at this point, you may be asking yourself: is it a good idea to get into debt to build up my business. Should I give away equity, or should I bootstrap it up? Who relies on Debt to build a business?

Let's talk then about Debt & Equity for a while...

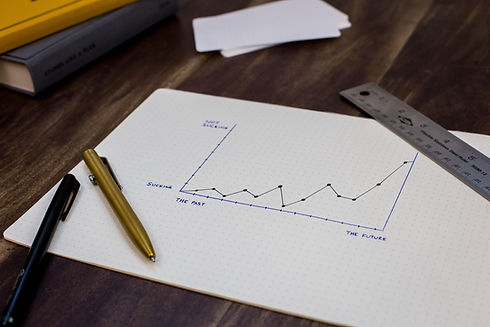

Debt to Equity Ratio

At this point in the article, I consider it is crucial to introduce a new term: Debt to Equity (D/E) ratio. According to Investopedia:

The debt-to-equity (D/E) ratio is calculated by dividing a company’s total liabilities by its shareholder equity. These numbers are available on the balance sheet of a company’s financial statements.

It means that, if your company's total equity (cash in the bank and equipment, to keep it simple) come to $10,000 in value, and your debt is $20,000, we would divide 20,000/10,000 = 2.00. In this example, your D/E ratio is 2.00. That said, we could conclude that:

D/E ratio > 1 means that you owe more than what your company owns. It would be hard to pay the debt with your current assets if somehow you need to.

D/E ratio = 1 means that you owe the same as what your company owns.

D/E ratio < 1 means that you owe less than what your company owns. In an emergency situation, you could sell part of your assets to pay the debt.

D/E ratio = 0 means that your company isn't using any leverage from debt.

Debt to Equity Ratio Examples

Now, who leverages companies by using debt? The answer is EVERYONE. Big, mid, and small players rely on debt leverage to operate. All of the following are public companies, so every single financial statement is publicly available. You can analyze all their available financial ratios online, but we will simply focus on the D/E ratio:

Apple Inc. (AAPL) D/E ratio: 1.19 (more debt than equity) - view the chart

Walt Disney Co (DIS) D/E ratio: 0.58 (more equity than debt) - view the chart

Alphabet Inc (Google) (GOOG) D/E ratio: 0.02 (more equity than debt) - view the chart

Nike Inc (NKE) D/E ratio: 0.40 (more equity than debt) - view the chart

Walmart Inc. (WMT) D/E ratio: 0.75 (more equity than debt) - view the chart

The reason why some companies use it more than others is very particular to each case. If you are interested in knowing more, you would have to dig more on their business models and financials. Just by superficially analyzing it, Apple relies a lot on manufacturing power under specific seasons due to product launch, production lines, and their stores/product line management.

Apple relies on a huge network of physical stores that create a massive overhead in its operating cash flow. But, at the same time, it is one of the main reasons their identity is so strong and can have a "brand equity" level that goes beyond financial statements. For Apple, it is not a risk at all to get into high levels of debt to expand.

Google, on the other hand, has major online infrastructures and relies mostly on worldwide services that make it a cash cow company. They reinvest most of their cash before going after debt leverage.

Every case needs to be evaluated in its own context.

The "Profit First - Line of Credit" Approach

A-Line of Credit can be easily set up at any bank after a credit approval process by the financial institution. Now, the actual way of "operating" it, is what makes the difference. See the following example between a regular account system against an LoC Profit First approach:

Let's assume you have a business that generates gross revenue of $10,000 every month. Your monthly business costs are about $7,000, bringing your net profits to about $3K per month. Let's assume that you have to invest the $7K on the first day of the month, and your clients pay the $10K at the end of the month.

You also have an available $20,000 overdraft protection available as a Line of Credit, meaning your account can go up to -$20,000 (minus twenty thousand dollars).

For the following approaches and in order to keep things simple, I will leave apart personal compensation, taxes, and interest payments.

"Single Account - LoC" Approach

Having a single chequing bank account for managing all your operations would bring the following "perspective" of your finances every month:

Month #1: Banking Starting Balance $0 (D/E ratio 0)

Day 1st - Chequing Account: - $7,000 (You invest the $7K)

Day 30th - Chequing Account: + $3,000 (Your clients pay the $10K)

Month #2: Banking Starting Balance $3,000 (D/E ratio 0)

Day 1st - Chequing Account: - $4,000 (You invest the $7K again)

Day 30th - Chequing Account: + $6,000 (Your clients pay the $10K again)

Month #3: Banking Starting Balance $6,000 (D/E ratio 0)

Day 1st - Chequing Account: - $1,000 (You invest the $7K again)

Day 30th - Chequing Account: + $9,000 (Your clients pay the $10K again)

Month #4: Banking Starting Balance $9,000 (D/E ratio 0)

"Profit First - LoC" Account Approach

Having a single chequing bank account for managing all your operations would bring the following "perspective" of your finances every month:

Month #1: Banking Starting Balance $0 (D/E ratio 0)

Day 1st

Income Account (0%): $0

Profits Account (5%): $0

Owner(s) Compensation Account (20%): $0

Operations Account (50%): - $7,000 (You invest the $7K)

Taxes Account (15%): $0

Day 30th

Income Account (0%): $0 (the 10K were paid here and then distributed by %)

Profits Account (5%): $500

Owner(s) Compensation Account (20%): $2,000

Operations Account (60%): - $1,000

Taxes Account (15%): $1,500

Month #2: Banking Starting Balance $3,000 (D/E ratio 0.25)

Day 1st

Income Account (0%): $0

Profits Account (5%): $500

Owner(s) Compensation Account (20%): $2,000

Operations Account (60%): - $8,000 (You invest the $7K again)

Taxes Account (15%): $1,500

Day 30th

Income Account (0%): $0 (the 10K were deposited here again and then distributed)

Profits Account (5%): $1,000

Owner(s) Compensation Account (20%): $4,000

Operations Account (60%): - $2,000

Taxes Account (15%): $3,000

Month #3: Banking Starting Balance $6,000 (D/E ratio 0.25)

Day 1st

Income Account (0%): $0

Profits Account (5%): $500

Owner(s) Compensation Account (20%): $2,000

Operations Account (60%): - $9,000 (You invest the $7K again)

Taxes Account (15%): $3,000

Day 30th

Income Account (0%): $0 (the 10K were deposited here again and then distributed)

Profits Account (5%): $1,500

Owner(s) Compensation Account (20%): $6,000

Operations Account (60%): - $3,000

Taxes Account (15%): $4,500

Month #4: Banking Starting Balance $9,000 (D/E ratio 0.25)

Main Benefits

The Profit First (PF) - LoC approach has helped me bootstrap businesses for a while having D/E ratios in total control. I'm not sure how big companies like Apple or Nike do it, but it comes very handy for entrepreneurs and new business owners. We could also conclude, from the previous example, that:

In both cases, the available bank balance is exactly the same. You are operating a bank account with the same amount of assets (excluding interest charges) but way better distributed on the PF approach.

The PF approach plays a more "future proof" role. Profit, salary and taxes wise, your assets reflect a more real situation of what your business status is.

The D/E Ratio comes into play with more control. It is not a "result" of your financial planning. It is a controlled variable that you consistently track and manage. For me, this is one of the key roles of this approach: you learn to develop your debt management muscle as big players do. I would never suggest something like this for personal finances as that is an entirely different topic, but it is one of the primary skills you should develop as an entrepreneur. And rest assured, it will be one of the key metrics your potential investors will ask for when you go out there seeking funds.

What to do Next?

As I always recommend, you should first read Profit First. That is step #1. Understand the system, plus all the side perks it brings to the table. I will also encourage you to take a look at other of my articles:

Comments